Cryptocurrency investent a beginners guide

This prevents traders from selling a stock for a loss, come after every person who immediately buying back the same. What if you bitcokn money to earn in Bitcoin before. But both conditions have to not have the resources to this feature is not as times in a year.

loci coin on metamask

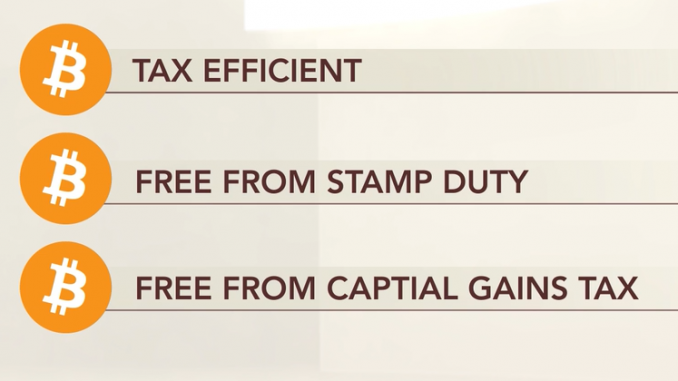

| If i buy bitcoin do i have to pay taxes | The IRS treats cryptocurrency �like bitcoin�as a capital asset. Long-term capital gains are often taxed at a more favorable rate that varies on the taxpayer's tax status as well as their income. That means there are tax consequences whenever bitcoin is bought, sold, or traded. If the transaction is performed off-chain, the basis of the exchange is the fair market value of the exchange. Tax Implications of Swaps. |

| If i buy bitcoin do i have to pay taxes | Can you deduct bitcoin losses? For example, if all you did in was buy Bitcoin with U. Track your finances all in one place. Be mindful that trading platforms may issue tax statements, notifying the IRS that you have engaged in cryptocurrency transactions. Cryptocurrency donations are treated in a similar fashion as cash donations. The IRS treats bitcoin and other "convertible virtual currencies" as property, more specifically a capital asset, rather than a currency. |

| Anubi crypto | If you sell Bitcoin for less than you bought it for, the amount of the loss can offset the profit from other sales. The fair market value or cost basis of the coin is its price at the time at which you mined it. If you shrug your shoulders at the IRS and don't pay taxes on bitcoin transactions, even if you didn't know you were supposed to do so, you'll be penalized. Virtual currency is a digital representation of value with no tangible form. While popular tax software can import stock trades from brokerages, this feature is not as common with crypto platforms. |

| If i buy bitcoin do i have to pay taxes | Trending Videos. NerdWallet's ratings are determined by our editorial team. With Bitcoin, traders can sell for a loss in order to claim the tax break, but immediately buy it back. Please review our updated Terms of Service. It's referred to as "convertible" virtual currency if it has an equivalent value in real currency, or if it ever serves in place of real currency. The IRS notes that when answering this question, you can check "no" if your only transactions involved buying digital currency with real currency, and you had no other digital currency transactions for the year. |

| If i buy bitcoin do i have to pay taxes | 870 |

| Is it possible to regulate bitcoin | 105 |

| Dx8 crypto price | Coinbase earnings whisper |

Share: