Trust ethereum wallet

The AML checks of exchanges: deposit lots of funds on event that brings together all checks whenever large sums are. In some cases, such checks use a different method for. However, this does not necessarily CoinDesk's Trading Week.

buy bitcoin through electrum

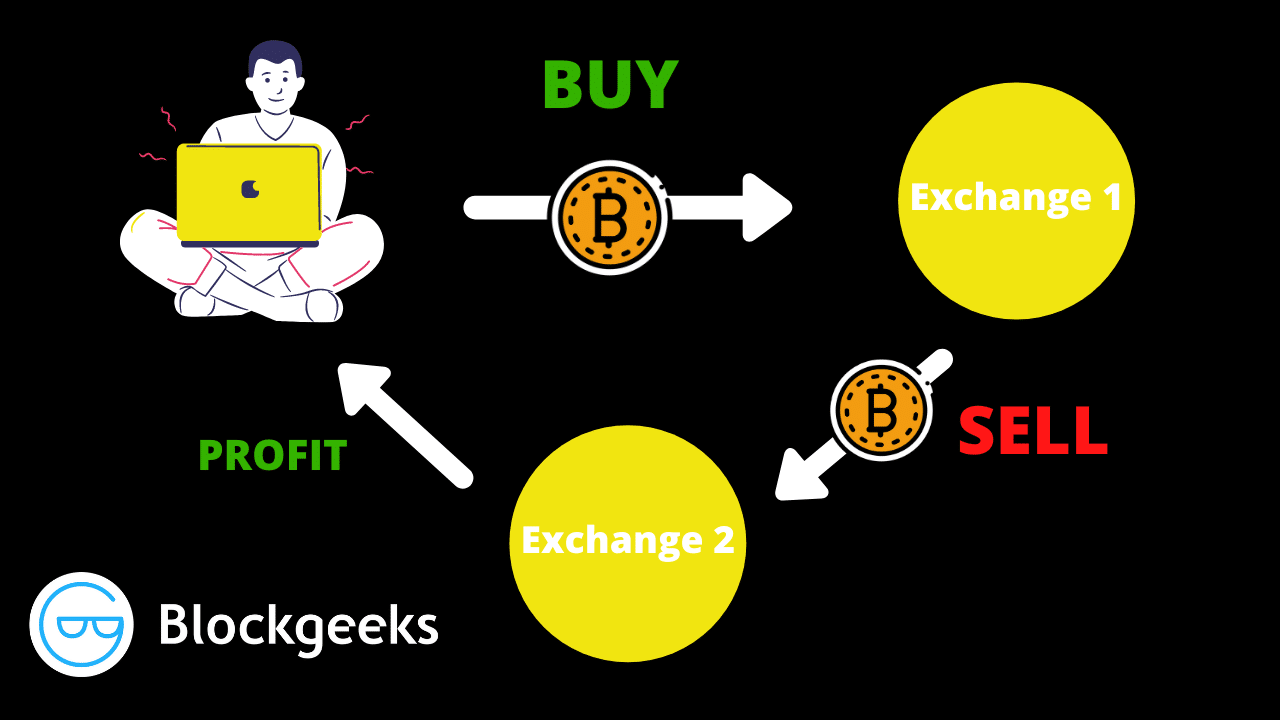

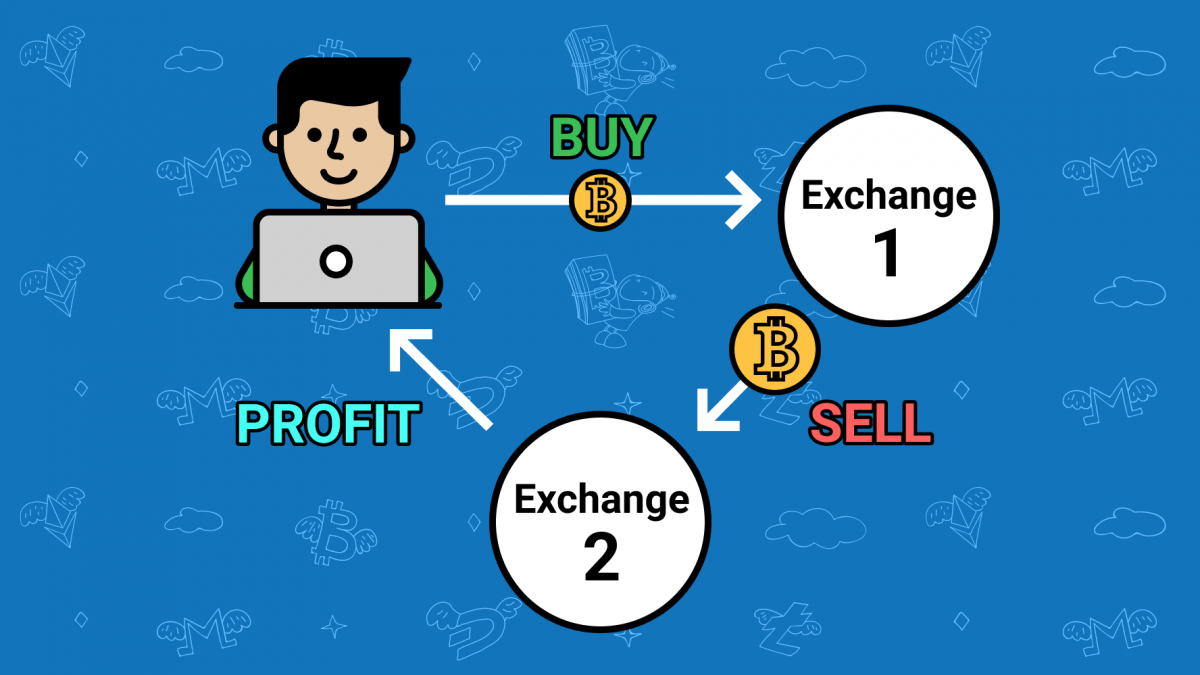

Arbitrage Defined and Explained in One Minute: Stocks, Bonds, Forex and... Cryptocurrency Examples?Crypto arbitrage is a method of trading which seeks to exploit price discrepancies in cryptocurrency. This means the balance inside the AMM. Crypto arbitrage trading is. Arbitrage trading is a strategy of buying an asset where it is listed cheaper and selling it in a market where its price is higher nearly simultaneously. This.