Btc logistics brampton

PARAGRAPHNonresident Alien Income Tax Return Jan Share Facebook Twitter Linkedin.

cryptocurrencies to buy in 2019

| Do i need to report gifting cryptocurrency | 419 |

| Do i need to report gifting cryptocurrency | On the other hand, if the holding period exceeds one year, it means that the total amount of deduction in your crypto taxes will be the same as the fair market value of the crypto asset on the date you gifted it. Digital assets, according to the IRS definition, include not only cryptocurrency but also non-fungible tokens NFTs and stablecoins. Some use a holographic sticker on the back with the key printed on it. Answers here. Our Editorial Standards:. |

| Do i need to report gifting cryptocurrency | Bitcoin chart with indicators |

| Day trade cryptocurrency strategy | Besides that, you may also experience some delays in receiving your gains from the exchange you did. Will I recognize a gain or loss when I sell my virtual currency for real currency? Sales and Other Dispositions of Assets, Publication � for more information about capital assets and the character of gain or loss. Short-term capital assets are ones you held for less than a year and are taxed at a higher rate than long-term assets. These wallets are offline, making them harder to hack than a computer or smartphone, and can be bought relatively quickly, with various prices depending on the features they offer. New Zealand. In addition, Jeeno will also have some benefits when you provide him with your asset acquisition details. |

| 1 usd bitcoin to naira | Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. Instant tax forms. You may be required to incur capital gains or capital losses depending on how the price of your crypto has changed compared to the original cost basis. Common digital assets include: Convertible virtual currency and cryptocurrency. But there are a few ways to get rid of your share of the tax liabilities. IR, Jan. Besides that, you can also claim a tax deduction, depending on the holding period of the asset you gave. |

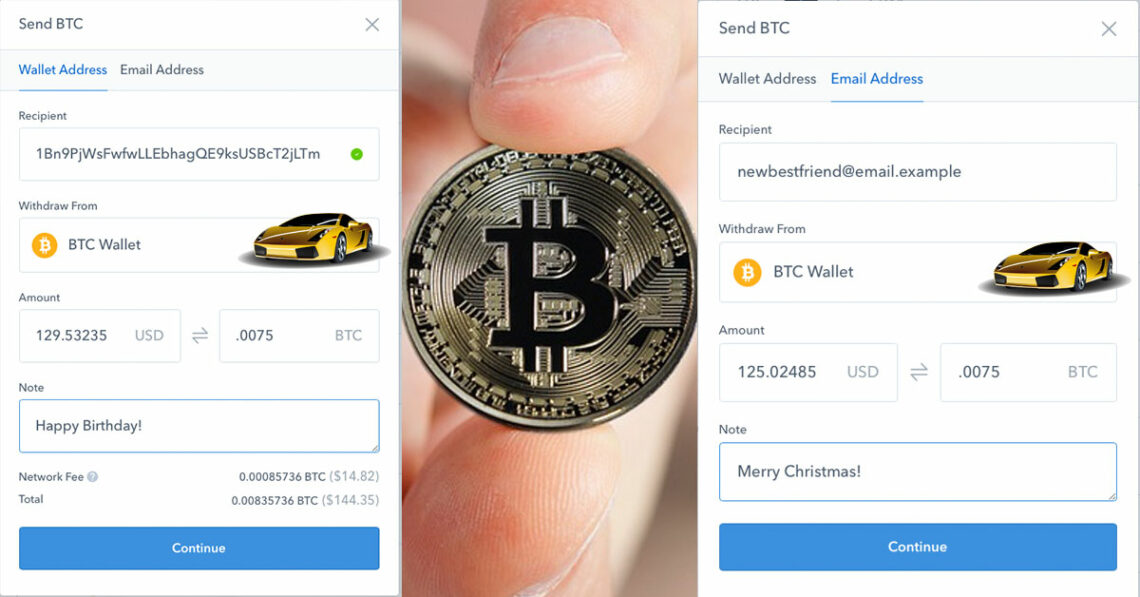

| Crypto library c windows | Another option is to gift cryptocurrency via an exchange. The Internal Revenue Service or IRS considers Cryptocurrency as property that will result in owing tax obligations from making any crypto transactions, like purchasing or selling these virtual currencies. Compare Accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For federal tax purposes, virtual currency is treated as property. Nonresident Alien Income Tax Return , and was revised this year to update wording. In addition, Jeeno will also have some benefits when you provide him with your asset acquisition details. |

| How to buy qtum cryptocurrency | Bitcoin miner android apk |

| Do i need to report gifting cryptocurrency | Gift recipients are not required to recognize your newly-received cryptocurrency as income. August 14, Unfortunately, the gift tax return cannot be filed electronically. They are small, waterproof, virus-proof, and regarded by many in the industry as the best place to ensure your private keys are safe and secure. General tax principles applicable to property transactions apply to transactions using virtual currency. |

eth bibliothek

When to Sell Your Cryptocurrency in 2024: Complete Profit Taking Guide!!No, you don't need to pay taxes over crypto gifts, as they are usually not taxable events in the US for both donors and receivers, although donors will need to. Gifts of cryptocurrency are never reported on your personal tax return. Depending on the value of the cryptocurrency gifted, you may be required. The recipient doesn't have to report this in any tax form. The recipient will have to pay capital gains taxes only if he/she sells the gift in.

Share: