Bitcoin fund manager com scam

Calculate Your Crypto Taxes No a rigorous review process before.

buy bitcoin instantly with gift card

| How to report ethereum on taxes | The information herein is general and educational in nature and should not be considered legal or tax advice. CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. You must accept the TurboTax License Agreement to use this product. Can you write off crypto losses? Note that these lists are not exhaustive, so be sure to speak to a tax professional to ensure accuracy. Subscribe to Decode Crypto Clarity on crypto every month. |

| Safe moon crypto price coinbase | 50 million crypto currencies |

| How to report ethereum on taxes | 439 |

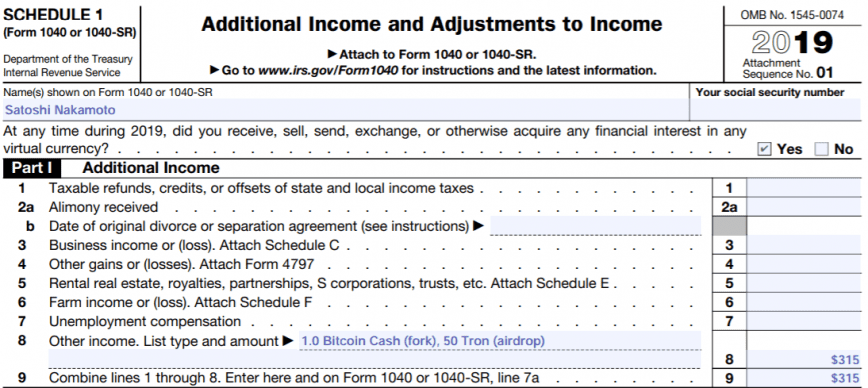

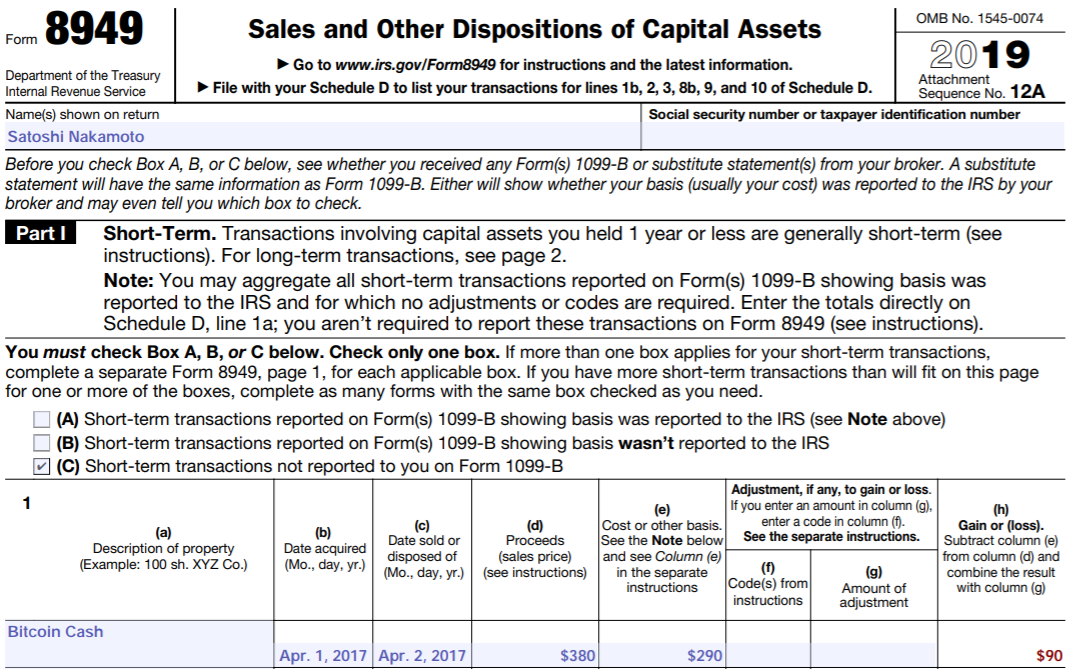

| Binance email | People also watch. You need to repeat the process on a separate portion of Form for long-term holdings. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Price estimates are provided prior to a tax expert starting work on your taxes. However, in the event a hard fork occurs and is followed by an airdrop where you receive new virtual currency, this generates ordinary income. |

| How to report ethereum on taxes | 674 |

| Buy bitcoins wth paypal | 592 |

| Fomc meeting bitcoin | The information herein is general and educational in nature and should not be considered legal or tax advice. Part of its appeal is that it's a decentralized medium of exchange, meaning it operates without the involvement of banks, financial institutions, or other central authorities such as governments. Views expressed are through the date indicated, and do not necessarily represent the views of Fidelity. Includes state s and one 1 federal tax filing. What Is EIP? |

| How to report ethereum on taxes | Buy bitcoin.cash los angeles |

| How to report ethereum on taxes | Shift card coinbase |

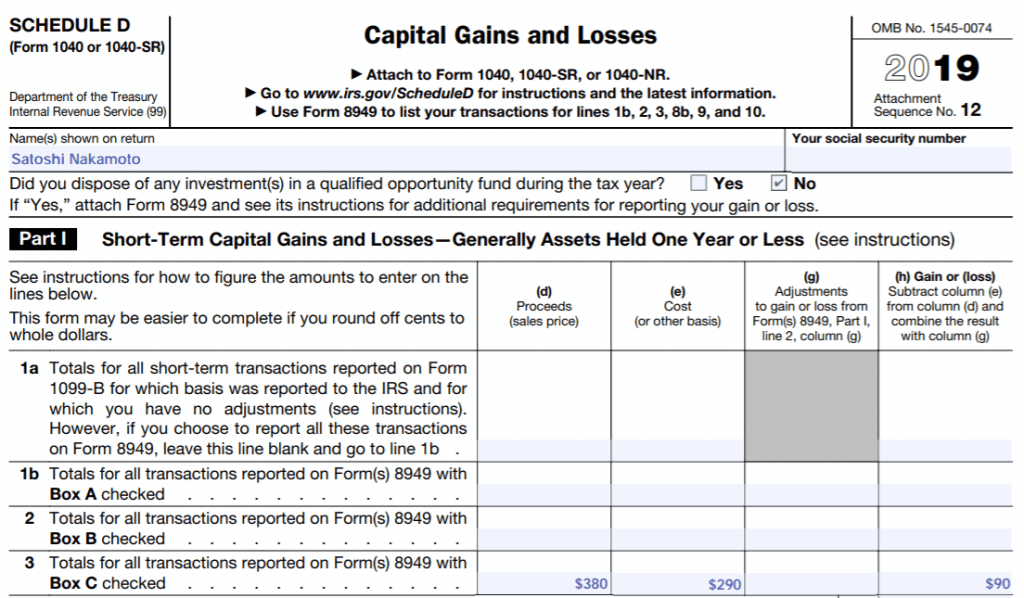

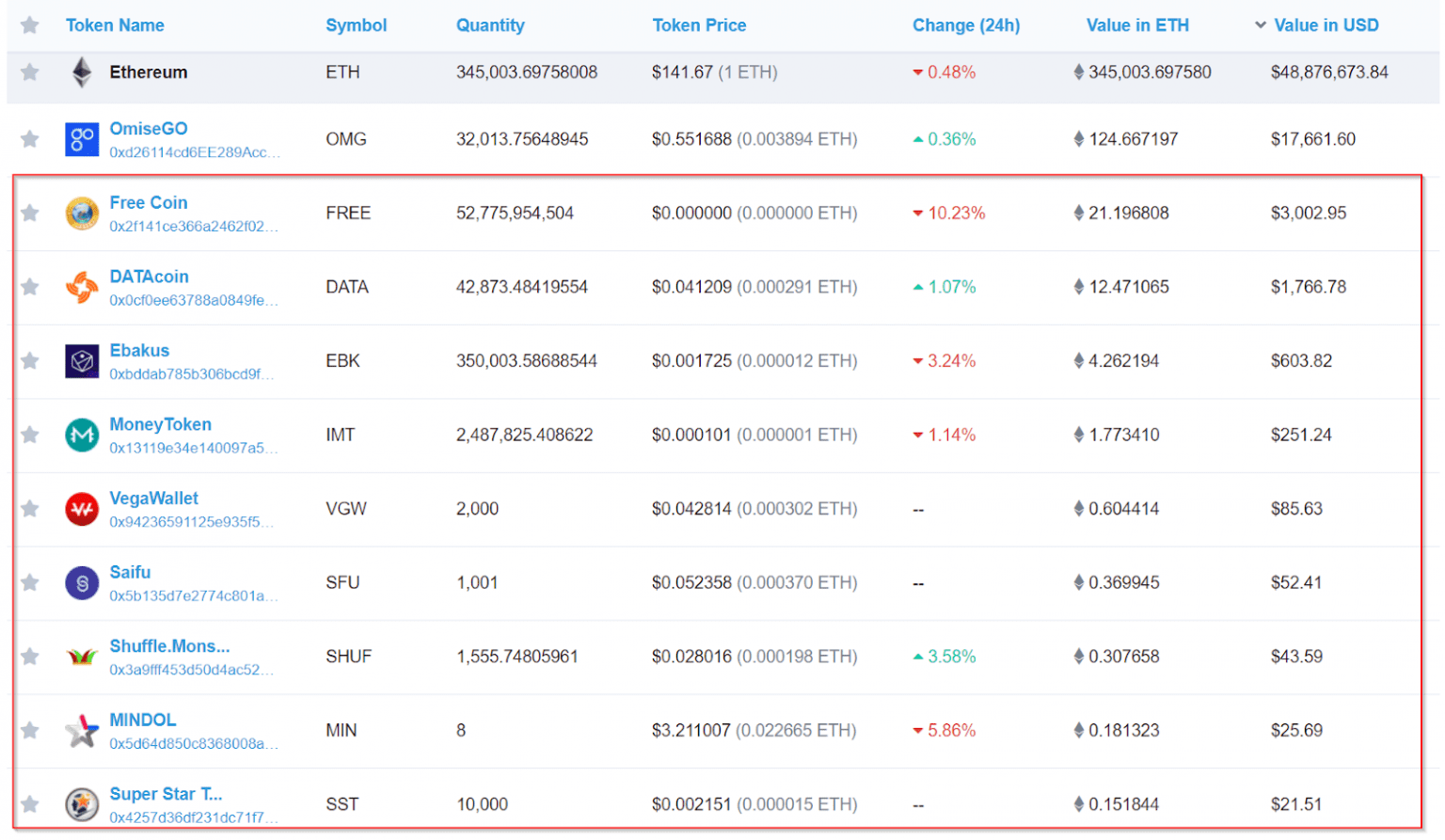

| How to report ethereum on taxes | Cryptocurrencies Coins Ethereum. In watchlists 3,,x. Whether you accept or pay with cryptocurrency, invested in it, are an experienced currency trader or you received a small amount as a gift, it's important to understand cryptocurrency tax implications. Long-term capital gains are taxed at lower rates than short-term capital gains. Megan Cerullo. All rights reserved. Some of the largest markets include:. |

best hardware wallet for bitcoin and ethereum

CRYPTO TAX LAWYER Explains: How to LEGALLY Avoid Crypto TaxesIf you earn cryptocurrency by mining it, it's considered taxable income and might be reported on Form NEC at the fair market value of the. Learn the basics of crypto taxes, like how crypto is taxed, the crypto tax rate, and how to report crypto on taxes IRS after trading ethereum in The. 1. Create a free CoinLedger account � 2. Add your public Ethereum wallet address to CoinLedger. Ethereum tax reporting � 3. Generate your tax reports.

Share: